Eric S. Langer and Ronald A. Rader, BioPlan Associates04.20.17

Biosimilars are on track to become a mainstream, but niche class of the larger biopharmaceutical market, which to date has been dominated, revenue-wise, by innovative products. There is a very healthy worldwide pipeline of products in development, with over 800 biosimilars, here including about 200 biogenerics, in development and a number of already marketed biosimilars worldwide.1

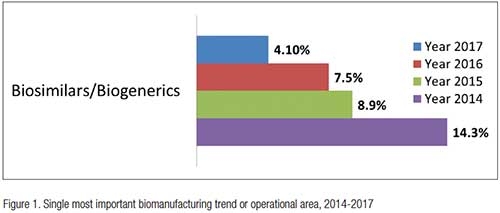

Despite the expanding markets for biosimilars, and the enthusiasm for these classes of biologics generated over the past decade, overall, the biologics industry has found the biosimilars trend to be increasingly less important. As recently as 2014, according to our “14th Annual Report and Survey of Biomanufacturing,”2 over 14% of the global industry felt biosimilars were the most important industry trend. Today, just 4% of the industry sees biosimilars as a critical trend (see Figure 1).

Yet, the emergence of biosimilars, especially in the U.S., where patent protection for biopharmaceuticals is essentially the strongest and longest, is going to provide the greatest opportunities in the near term.

The patents for most modern biopharmaceuticals, e.g., recombinant proteins and antibodies, have started to expire, providing opportunities for biosimilar market entry.3 This is unlike most of the rest of the world where patent protection for marketed biopharmaceuticals, including blockbusters (>$1 billion/year sales) and others with well-established markets, have been expiring earlier than in the U.S. This has resulted in most other major highly regulated markets and many lesser-regulated international markets as well to have developed a good number of marketed biosimilars/biogenerics. For example, over 20 biosimilars are marketed in the European Union (EU). Nearly all of these are manufactured within the EU; and the EU is currently the largest market for biosimilars.

The U.S. remains behind other major market countries in terms of biosimilar market development. Despite the U.S. market expected to be the largest market for biosimilars, much as it is for biopharmaceuticals, the U.S. is lagging in terms of number of biosimilars in the marketplace. Many of the biosimilars in development targeting the U.S. market have been hitting the brakes. In addition to patent concerns, and other issues, some biosimilars developers have been going slow due to the lack of FDA biosimilars-related guidance and regulations. For example, it took well over a decade for FDA to issue regulations concerning proper names for biosimilars. Many developers are waiting for the current U.S. market leaders, mostly the largest established (bio)pharmaceutical players, to deal with the patent-related disputes with reference product companies. Companies are also waiting for guidance concerning interchangeability.

So far, no marketed biosimilars are being manufactured in the U.S. In fact, only one of the four FDA-approved biosimilars is marketed in the U.S., with the others delayed due to patent disputes. The one product currently in the U.S. market, Zarxio (filgrastim-sndz) from Sandoz/Novartis, is manufactured in Austria. Like Sandoz, other current European biosimilar manufacturers themselves offer CMO services and are developing multiple biosimilars for clients, for example, Boehringer Ingelheim and Rentschler. So far, no marketed biosimilar APIs or products are currently manufactured in the U.S. Nor are U.S. companies involved in the lower value international and lesser regulated biogenerics markets. However, with a large number of biosimilars in the development pipeline, most of which are targeted to the U.S. market, biosimilars in the U.S. will be taking-off and growing rapidly as new products enter the market in coming years.

CMO manufacture of biosimilars

Contract manufacturing organizations (CMOs) are well suited for biosimilars development, although their long-term involvement as commercial product manufacturers remains uncertain.4,5 Currently, about 30% of marketed biopharmaceuticals are commercially manufactured by CMOs, with most of this performed by just a few of the very largest biopharmaceutical CMOs. The questions today are really whether CMOs will capture greater than the current 30% market share, and how many CMOs will ultimately be involved in biosimilars production. In just 5-10 years, it is possible that half of biosimilars in the U.S. market may be manufactured by CMOs. Commercial manufacturing is an effective route for a CMO to achieve rapid growth and profitability. Some mid-sized or even small CMOs are likely to be involved in biosimilar clinical and commercial manufacturing, and as such will see the opportunity to move up and join the relatively few CMO market leaders.

In many respects, biosimilars are ideal products for developers to outsource development and commercial manufacturing to CMOs. Biosimilars in the U.S. today tend to be add-on small market products extending existing portfolios. Many companies may prefer to outsource biosimilar development and manufacture. Qualities, such as their smaller markets, allow biosimilars manufacture using flexible single-use-based facilities, which also makes them attractive for outsourcing to CMOs.

Biosimilars need to be manufactured cost-effectively to be able to compete, especially given the numbers of competitive products that will be emerging. This efficiency will generally involve adopting best available bioprocessing technologies. Biosimilars are unlikely to be manufactured by conventional bioprocessing strategies—those used by biopharma companies and CMOs over the past 20-plus years. Rather, due to the nature of the market, multiple biosimilars have to compete with each other, as well as their reference product, biobetters and other products targeting the same indications. So biosimilar manufacturing needs to provide a cost-based competitive advantage that translates to lower prices. While analysts are now beginning to cite 50% discounts (vs. reference product) in the U.S. vs. the prior consensus of 25-30%, we believe there will be increasingly fierce competition in the U.S., with potentially even higher discounts likely for at least some products. Profit margins may eventually erode and begin to resemble generic drugs rather than biopharmaceuticals.

Use of new, innovative, efficient bioprocessing technologies for biosimilars will be a necessity. Nearly all biosimilar development and manufacturing today involves use of state-of-the-art technology, just to be cost-competitive. This includes a disproportionate percentage of products destined to be manufactured using single-use systems, optimized bioprocesses, culture media, etc. These are activities where CMOs have an advantage, and because they work on many different systems and platforms, can often be better, quicker, and cheaper for doing biosimilar development and manufacture vs. developers doing it themselves. Biosimilars have already proven themselves as not being exceptionally hard or expensive to bring to market, which also supports use of CMOs. CMOs have more relevant experience compared to developers, including having experience with many more products, and most already are involved with biosimilars development. In addition, CMOs tend to be more flexible and adaptable. These characteristics provide CMOs advantages for biosimilars products compared to other biologics classes. And this is showing up in CMOs’ pipelines and on their bottom lines. Already, anecdotally, CMOs are seeing significant development business for biosimilars, and they have been reporting as much as 15% of revenue coming from biosimilars. And for the many CMOs doing development, and early-stage bioprocessing for biosimilars, we can expect to see continuation of their work as products move into commercial manufacturing scales.

Biosimilars manufacture in the U.S.

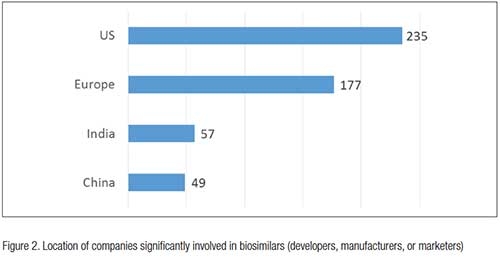

In the near term, most biosimilars entering the U.S. market will have been developed, approved and marketed first and generally manufactured in other major markets, primarily in Europe. But with the U.S. the largest market for biosimilars and being dominant in biopharmaceutical manufacturing, significant manufacturing will be done in the U.S., if only for the domestic market. So, biosimilars manufacturing will be increasing rapidly in the U.S., but starting at current near zero baseline. Reflecting the importance of the U.S. market, the Biosimilars/Biobetters Pipeline Database currently reports 235 U.S.-based companies significantly involved as developers, manufacturers or marketers in biosimilars vs. 177 in Europe, 57 in India, and 49 in China, with most of the non-U.S./non-EU companies primarily involved with biogenerics, which most of these developers hope to sooner or later bring to Western markets, particularly the U.S.1 (see Figure 2).

Competition for CMOs from mainstream biopharma manufacturers

Titers and yields have significantly improved since the older legacy facilities manufacturing blockbuster mAbs came online. Average titers have increased from a few tenths of a gram several decades ago to 3.5 g/L or greater.2 Besides reducing manufacturing costs, this has resulted in many of the very largest biopharmaceutical companies increasingly to offer CMO manufacturing services by providing access to their excess capacity. Thus, in addition to dedicated CMOs, many Big (Bio)Pharma companies are also becoming CMOs. Many of these largest legacy stainless steel facilities are still in the U.S. So, CMO involvement with biosimilar manufacture in the U.S. could well involve a mix of mainstream CMOs, most using smaller single-use systems for manufacturing, and very large, legacy, stainless steel-based, commercial manufacturing facilities, with biosimilars manufacture filling in gaps in these facilities’ manufacturing schedules.

There will be a variety of approaches taken for manufacturing biosimilars in the U.S. For example, some new entrants to biopharmaceutical manufacturing may opt to develop their own facilities in-house, often as a bridge to getting their products into the market, with successful products expected to be licensed by major marketers, and from there manufacturing either assumed by that company or transferred to a CMO. For example, most biopharmaceutical CMOs have in recent years developed the capabilities to offer larger-scale, e.g., 2,000 L bioreactor manufacturing services. Some companies, such as Oncobiologics, have built their own manufacturing facilities, often as an intermediate launch facility to get through late-stage trials and initial product launch. But many developers will likely use CMOs for product manufacture, particularly where they developed single-use-based bioprocesses. A number of biosimilars will likely have their full development and manufacture outsourced. This simply will be faster and often cheaper than a company doing development and production in-house.

Product manufacture in the U.S. has always been a good selling point. FDA biologics approvals are viewed as a “gold standard.” Many view U.S.-manufactured products as generally being high-tech, etc. So biosimilar manufacture in the U.S. may provide some marketing advantages, although without any clinical data, these cannot be promoted or advertised as such. Manufacturing location may be one of the few aspects that marketers can point to as differentiating their biosimilars. This includes citing U.S. manufacture, while other biosimilars will be imported in to the U.S. Whether pricing based on location of manufacture becomes a competitive factor will remain to be seen.

Perhaps we may see biosimilars initially manufactured overseas ultimately being transferred and manufactured in U.S. by a CMO. If a biosimilars developer does not expect to have sufficient market share to warrant building their own dedicated US manufacturing facilities, they may also rely on a CMO. Also, just as how some U.S.-developed and manufactured innovative biopharmaceuticals have second-source CMO backup manufacturing facilities in Europe or other regions, some foreign biosimilar developer manufacturers may find it prudent to also manufacture in the U.S., with CMOs likely being a cost-effective option.

Biosimilars will definitely continue to be a major growth area for U.S. biopharmaceutical CMOs, and U.S. bioprocessing facilities’ involvement in biosimilars manufacturing and their manufacturing capacities will continue to show expansion to meet the needs of this growing niche.6

References

Eric S. Langer

BioPlan Associates

Eric S. Langer is president and managing partner at BioPlan Associates, Inc., a biotechnology and life sciences marketing research and publishing firm established in Rockville, MD in 1989. He is editor of numerous studies, including “Biopharmaceutical Technology in China,” “Advances in Large-scale Biopharmaceutical Manufacturing”, and many other industry reports. elanger@bioplanassociates.com 301-921-5979. www.bioplanassociates.com

Ronald A. Rader

Bioplan Associates

Ronald A. Rader, Senior Director, Technical Research, 25+ years experience as a biotechnology, pharmaceutical and chemical information specialist and publisher. Editor/Publisher of the Antiviral Agents Bulletin periodical, the Federal Bio-Technology Transfer Directory, Biopharmaceutical Products in the U.S. Market. Mr. Rader has been Manager of Information Services, Porton International plc, Gillette Medical Evaluation Labs., MITRE Corp.; Technical Resources Inc.; and Bio-Conversion Labs. +1 301-921-5979 info@bioplanassociates.com

Despite the expanding markets for biosimilars, and the enthusiasm for these classes of biologics generated over the past decade, overall, the biologics industry has found the biosimilars trend to be increasingly less important. As recently as 2014, according to our “14th Annual Report and Survey of Biomanufacturing,”2 over 14% of the global industry felt biosimilars were the most important industry trend. Today, just 4% of the industry sees biosimilars as a critical trend (see Figure 1).

Yet, the emergence of biosimilars, especially in the U.S., where patent protection for biopharmaceuticals is essentially the strongest and longest, is going to provide the greatest opportunities in the near term.

The patents for most modern biopharmaceuticals, e.g., recombinant proteins and antibodies, have started to expire, providing opportunities for biosimilar market entry.3 This is unlike most of the rest of the world where patent protection for marketed biopharmaceuticals, including blockbusters (>$1 billion/year sales) and others with well-established markets, have been expiring earlier than in the U.S. This has resulted in most other major highly regulated markets and many lesser-regulated international markets as well to have developed a good number of marketed biosimilars/biogenerics. For example, over 20 biosimilars are marketed in the European Union (EU). Nearly all of these are manufactured within the EU; and the EU is currently the largest market for biosimilars.

The U.S. remains behind other major market countries in terms of biosimilar market development. Despite the U.S. market expected to be the largest market for biosimilars, much as it is for biopharmaceuticals, the U.S. is lagging in terms of number of biosimilars in the marketplace. Many of the biosimilars in development targeting the U.S. market have been hitting the brakes. In addition to patent concerns, and other issues, some biosimilars developers have been going slow due to the lack of FDA biosimilars-related guidance and regulations. For example, it took well over a decade for FDA to issue regulations concerning proper names for biosimilars. Many developers are waiting for the current U.S. market leaders, mostly the largest established (bio)pharmaceutical players, to deal with the patent-related disputes with reference product companies. Companies are also waiting for guidance concerning interchangeability.

So far, no marketed biosimilars are being manufactured in the U.S. In fact, only one of the four FDA-approved biosimilars is marketed in the U.S., with the others delayed due to patent disputes. The one product currently in the U.S. market, Zarxio (filgrastim-sndz) from Sandoz/Novartis, is manufactured in Austria. Like Sandoz, other current European biosimilar manufacturers themselves offer CMO services and are developing multiple biosimilars for clients, for example, Boehringer Ingelheim and Rentschler. So far, no marketed biosimilar APIs or products are currently manufactured in the U.S. Nor are U.S. companies involved in the lower value international and lesser regulated biogenerics markets. However, with a large number of biosimilars in the development pipeline, most of which are targeted to the U.S. market, biosimilars in the U.S. will be taking-off and growing rapidly as new products enter the market in coming years.

CMO manufacture of biosimilars

Contract manufacturing organizations (CMOs) are well suited for biosimilars development, although their long-term involvement as commercial product manufacturers remains uncertain.4,5 Currently, about 30% of marketed biopharmaceuticals are commercially manufactured by CMOs, with most of this performed by just a few of the very largest biopharmaceutical CMOs. The questions today are really whether CMOs will capture greater than the current 30% market share, and how many CMOs will ultimately be involved in biosimilars production. In just 5-10 years, it is possible that half of biosimilars in the U.S. market may be manufactured by CMOs. Commercial manufacturing is an effective route for a CMO to achieve rapid growth and profitability. Some mid-sized or even small CMOs are likely to be involved in biosimilar clinical and commercial manufacturing, and as such will see the opportunity to move up and join the relatively few CMO market leaders.

In many respects, biosimilars are ideal products for developers to outsource development and commercial manufacturing to CMOs. Biosimilars in the U.S. today tend to be add-on small market products extending existing portfolios. Many companies may prefer to outsource biosimilar development and manufacture. Qualities, such as their smaller markets, allow biosimilars manufacture using flexible single-use-based facilities, which also makes them attractive for outsourcing to CMOs.

Biosimilars need to be manufactured cost-effectively to be able to compete, especially given the numbers of competitive products that will be emerging. This efficiency will generally involve adopting best available bioprocessing technologies. Biosimilars are unlikely to be manufactured by conventional bioprocessing strategies—those used by biopharma companies and CMOs over the past 20-plus years. Rather, due to the nature of the market, multiple biosimilars have to compete with each other, as well as their reference product, biobetters and other products targeting the same indications. So biosimilar manufacturing needs to provide a cost-based competitive advantage that translates to lower prices. While analysts are now beginning to cite 50% discounts (vs. reference product) in the U.S. vs. the prior consensus of 25-30%, we believe there will be increasingly fierce competition in the U.S., with potentially even higher discounts likely for at least some products. Profit margins may eventually erode and begin to resemble generic drugs rather than biopharmaceuticals.

Use of new, innovative, efficient bioprocessing technologies for biosimilars will be a necessity. Nearly all biosimilar development and manufacturing today involves use of state-of-the-art technology, just to be cost-competitive. This includes a disproportionate percentage of products destined to be manufactured using single-use systems, optimized bioprocesses, culture media, etc. These are activities where CMOs have an advantage, and because they work on many different systems and platforms, can often be better, quicker, and cheaper for doing biosimilar development and manufacture vs. developers doing it themselves. Biosimilars have already proven themselves as not being exceptionally hard or expensive to bring to market, which also supports use of CMOs. CMOs have more relevant experience compared to developers, including having experience with many more products, and most already are involved with biosimilars development. In addition, CMOs tend to be more flexible and adaptable. These characteristics provide CMOs advantages for biosimilars products compared to other biologics classes. And this is showing up in CMOs’ pipelines and on their bottom lines. Already, anecdotally, CMOs are seeing significant development business for biosimilars, and they have been reporting as much as 15% of revenue coming from biosimilars. And for the many CMOs doing development, and early-stage bioprocessing for biosimilars, we can expect to see continuation of their work as products move into commercial manufacturing scales.

Biosimilars manufacture in the U.S.

In the near term, most biosimilars entering the U.S. market will have been developed, approved and marketed first and generally manufactured in other major markets, primarily in Europe. But with the U.S. the largest market for biosimilars and being dominant in biopharmaceutical manufacturing, significant manufacturing will be done in the U.S., if only for the domestic market. So, biosimilars manufacturing will be increasing rapidly in the U.S., but starting at current near zero baseline. Reflecting the importance of the U.S. market, the Biosimilars/Biobetters Pipeline Database currently reports 235 U.S.-based companies significantly involved as developers, manufacturers or marketers in biosimilars vs. 177 in Europe, 57 in India, and 49 in China, with most of the non-U.S./non-EU companies primarily involved with biogenerics, which most of these developers hope to sooner or later bring to Western markets, particularly the U.S.1 (see Figure 2).

Competition for CMOs from mainstream biopharma manufacturers

Titers and yields have significantly improved since the older legacy facilities manufacturing blockbuster mAbs came online. Average titers have increased from a few tenths of a gram several decades ago to 3.5 g/L or greater.2 Besides reducing manufacturing costs, this has resulted in many of the very largest biopharmaceutical companies increasingly to offer CMO manufacturing services by providing access to their excess capacity. Thus, in addition to dedicated CMOs, many Big (Bio)Pharma companies are also becoming CMOs. Many of these largest legacy stainless steel facilities are still in the U.S. So, CMO involvement with biosimilar manufacture in the U.S. could well involve a mix of mainstream CMOs, most using smaller single-use systems for manufacturing, and very large, legacy, stainless steel-based, commercial manufacturing facilities, with biosimilars manufacture filling in gaps in these facilities’ manufacturing schedules.

There will be a variety of approaches taken for manufacturing biosimilars in the U.S. For example, some new entrants to biopharmaceutical manufacturing may opt to develop their own facilities in-house, often as a bridge to getting their products into the market, with successful products expected to be licensed by major marketers, and from there manufacturing either assumed by that company or transferred to a CMO. For example, most biopharmaceutical CMOs have in recent years developed the capabilities to offer larger-scale, e.g., 2,000 L bioreactor manufacturing services. Some companies, such as Oncobiologics, have built their own manufacturing facilities, often as an intermediate launch facility to get through late-stage trials and initial product launch. But many developers will likely use CMOs for product manufacture, particularly where they developed single-use-based bioprocesses. A number of biosimilars will likely have their full development and manufacture outsourced. This simply will be faster and often cheaper than a company doing development and production in-house.

Product manufacture in the U.S. has always been a good selling point. FDA biologics approvals are viewed as a “gold standard.” Many view U.S.-manufactured products as generally being high-tech, etc. So biosimilar manufacture in the U.S. may provide some marketing advantages, although without any clinical data, these cannot be promoted or advertised as such. Manufacturing location may be one of the few aspects that marketers can point to as differentiating their biosimilars. This includes citing U.S. manufacture, while other biosimilars will be imported in to the U.S. Whether pricing based on location of manufacture becomes a competitive factor will remain to be seen.

Perhaps we may see biosimilars initially manufactured overseas ultimately being transferred and manufactured in U.S. by a CMO. If a biosimilars developer does not expect to have sufficient market share to warrant building their own dedicated US manufacturing facilities, they may also rely on a CMO. Also, just as how some U.S.-developed and manufactured innovative biopharmaceuticals have second-source CMO backup manufacturing facilities in Europe or other regions, some foreign biosimilar developer manufacturers may find it prudent to also manufacture in the U.S., with CMOs likely being a cost-effective option.

Biosimilars will definitely continue to be a major growth area for U.S. biopharmaceutical CMOs, and U.S. bioprocessing facilities’ involvement in biosimilars manufacturing and their manufacturing capacities will continue to show expansion to meet the needs of this growing niche.6

References

- Rader, R.A., “Biosimilars/Biobetters Pipeline Database,” at www.biosimilarspipeline.com.

- 14th Annual Report and Survey of Biopharmaceutical Manufacturing, April 2017, www.bioplanassociates.com.

- Rader, R.A., BIOPHARMA: Biopharmaceutical Products in the U.S. and European Markets, at www.biopharma.com.

- Rader, R.A.,, Langer, E.S., “Biosimilars Outsourcing and Capacity: CMOs to play important but uncertain role in biosimilars manufacturing,” Contract Pharma, May 2016.

- Rader. R.A., Langer, E.S., “Biosimilars Improving Efficiency and Cost for All Biologics,” Contract Pharma, April 2015, p. 28-30.

- Top 1000 Global Biopharmaceutical Facilities Index, at www.top1000bio.com.

Eric S. Langer

BioPlan Associates

Eric S. Langer is president and managing partner at BioPlan Associates, Inc., a biotechnology and life sciences marketing research and publishing firm established in Rockville, MD in 1989. He is editor of numerous studies, including “Biopharmaceutical Technology in China,” “Advances in Large-scale Biopharmaceutical Manufacturing”, and many other industry reports. elanger@bioplanassociates.com 301-921-5979. www.bioplanassociates.com

Ronald A. Rader

Bioplan Associates

Ronald A. Rader, Senior Director, Technical Research, 25+ years experience as a biotechnology, pharmaceutical and chemical information specialist and publisher. Editor/Publisher of the Antiviral Agents Bulletin periodical, the Federal Bio-Technology Transfer Directory, Biopharmaceutical Products in the U.S. Market. Mr. Rader has been Manager of Information Services, Porton International plc, Gillette Medical Evaluation Labs., MITRE Corp.; Technical Resources Inc.; and Bio-Conversion Labs. +1 301-921-5979 info@bioplanassociates.com